-

The Goals and Risk-based Asset Pricing Model (GRAPM)

By

DR. ARUN MURALIDHAR

-

Practical Application of GRAPM

By

DR. ARUN MURALIDHAR

-

Collaborators

By

DR. ARUN MURALIDHAR

-

Journals that Have Published Articles

By

DR. ARUN MURALIDHAR

-

Related Research

By

DR. ARUN MURALIDHAR

-

Awards/Podcasts

By

DR. ARUN MURALIDHAR

Realitivity in Finance

1. REALITY 1 – Goals are stochastic (e.g., pension liabilities) – and not “Background Risk”, “Habit” or “KUJ” or deterministic as in CAPM

2. REALITY 2- Investors have multiple stochastic goals (retirement, kid’s education, post-retirement health) and not just 1.

3. RELATIVITY 1 – Investors maximize goal-relative risk-adjusted returns – and not “Epstein-Zin” utility functions! or additive utility functions.

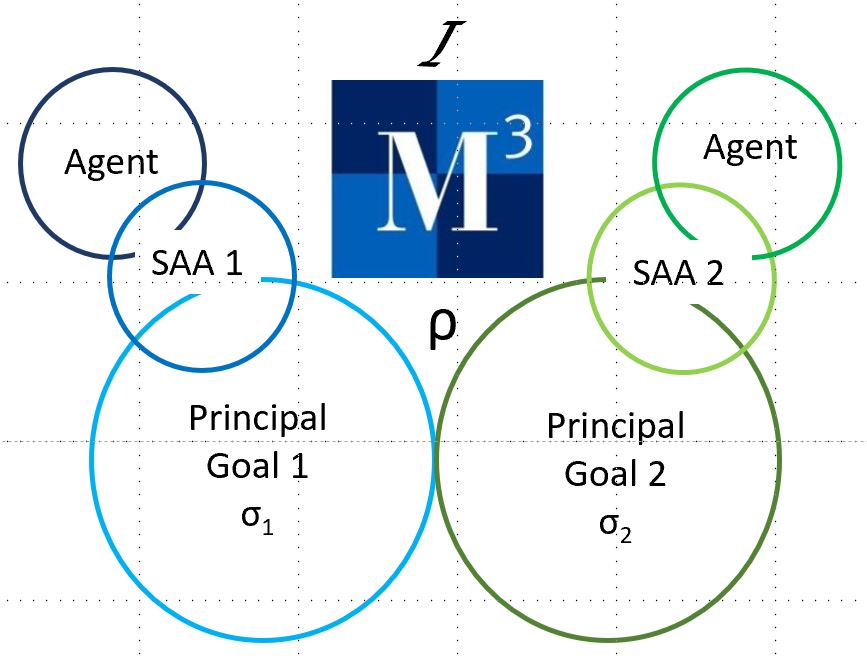

4. RELATIVITY 2 – They hire agents/ #assetmanagers to manage portfolios (delegation at many levels – a Board to an investment team; the team to asset managers – passive or active)

5. REALITY/RELATIVITY 3 – They want (hopefully) skillful agents – largely ignored in the literature. So can’t use #Sharpe ratios but must use #Mcube.

6. REALITY 4 – They specify risk through an absolute volatility and a target #trackingerror in their #investment Policy Statements – and not some random/arbitrary “risk aversion” parameter.

REALITY 5 – An effective asset pricing model should also provide consistent #assetallocation and risk-adjusted performance measures to be useful – only #capm does this; 99% of other asset pricing models fail this test (e.g., APT ).